Montenegro Wellness Centre

Budva Adriatic Coast • 55-Room Premium Wellness Retreat

Acquire and transform a beachfront property into a flagship wellness centre with a custom concept. Targeting European and Arab affluent wellness travelers

Why Montenegro, Why Budva

Strategic location at the crossroads of European and Middle Eastern wellness tourism

Adriatic Coastline

Premium beachfront location near Budva, Montenegro's tourism hub with 300+ days of sunshine

International Access

Tivat Airport 20km, direct flights from UAE, UK, Russia, and Western Europe

EU Candidate Country

Montenegro is an EU candidate with stable regulation, investor-friendly policies, and competitive 9% corporate tax — one of the lowest in Europe

Target Demographics

European wellness tourists and Arab HNW individuals seeking Adriatic wellness retreats

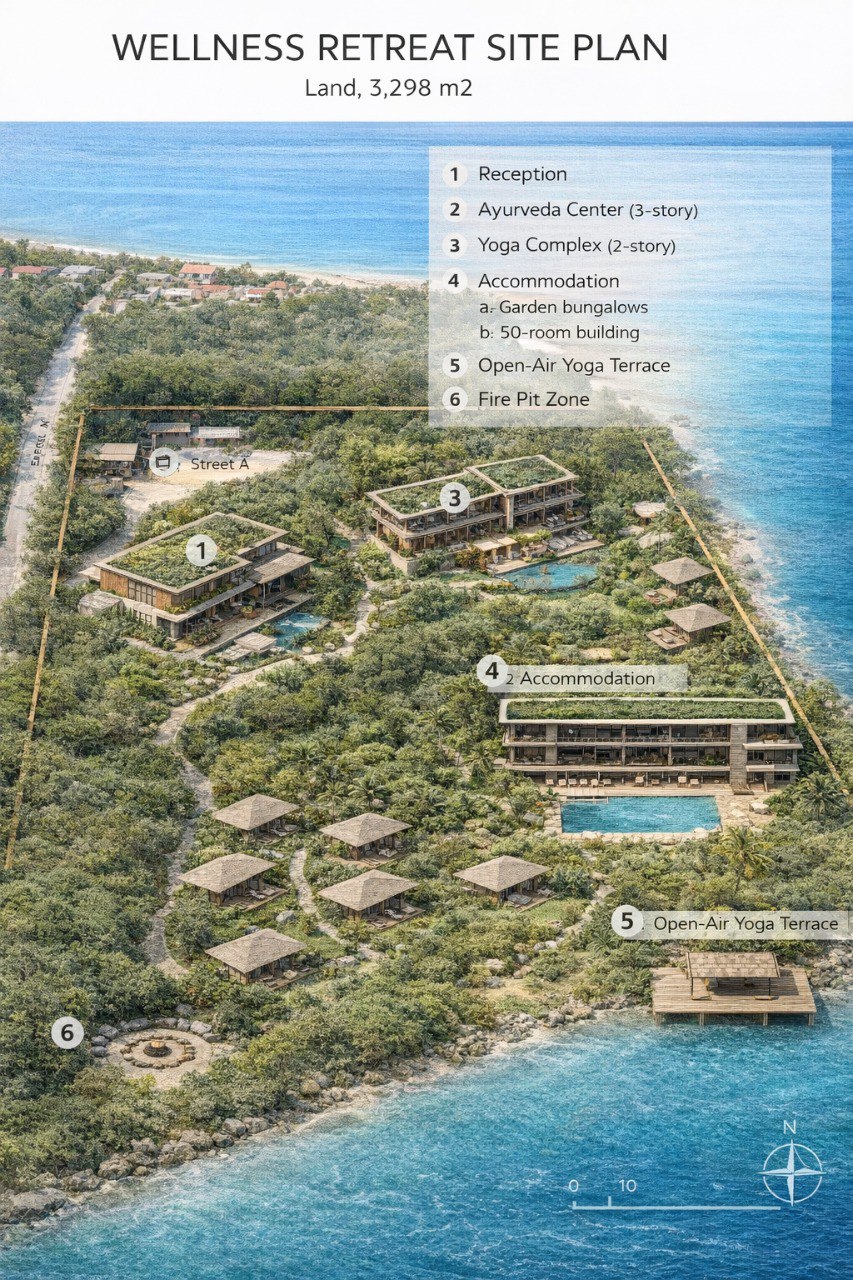

Property Overview

The property is a 55-room hotel structure located 300 meters from a private beach access point in Budva, Montenegro's premier Adriatic tourism destination. The existing building is structurally sound but requires partial interior reconstruction and wellness facility additions.

Renovation & Development Plan

Phase 1: Core Renovation (Months 1-3)

- • Interior room renovations (50 hotel rooms)

- • Lobby, reception, and common areas redesign

- • MEP (mechanical, electrical, plumbing) upgrades

- • Soft opening with hotel accommodations only

Phase 2: Wellness Addition (Months 3-6)

- • 500 sqm wellness centre construction

- • IV therapy rooms, hyperbaric chamber, ozone suite

- • Massage, yoga, and meditation studios

- • Rooftop wellness terrace with sea views

Phase 3: Grand Opening (Month 6)

- • Full wellness centre operational

- • Launch retreat programs (7/14/21-day)

- • Marketing campaign targeting EU & Arab markets

Property Gallery

Current state of the property — well-maintained structure ready for transformation

Hotel Facade & Entrance

Guest Rooms

Interior Spaces

Common Areas

.jpg)

Sea Views

Location & Surroundings

Wellness Centre Vision

Transforming the property into a world-class longevity and wellness destination

Wellness Centre Concept

The Montenegro centre will be the first European location in the LGC wellness network, with a fully custom concept designed for the Adriatic market — combining relaxation, wellness retreats, and premium hospitality.

Core Services:

- IV Therapy Lounge: NAD+, glutathione, vitamin infusions

- Hyperbaric Oxygen Chamber: Cellular regeneration treatments

- Ozone Therapy Suite: Immune system optimization

- Ayurvedic Treatments: Massage, Panchakarma, dosha balancing

- Longevity Retreats: 7/14/21-day comprehensive programs

The design aesthetic blends Mediterranean architecture with modern wellness minimalism — natural materials, calming earth tones, and seamless indoor-outdoor flow to maximize the coastal setting.

.jpg)

Treatment Spaces

.jpg)

Relaxation Areas

.jpg)

Wellness Facilities

Land Value & Development Upside

Beyond operational cash flow, this property offers significant real estate appreciation through land value and unused development rights

1,200 sqm Land Plot

Beachfront land 300m from coastline in prime Budva zone

Development Rights Upside

Potential to add residential or commercial units on unused FAR

Location Premium

Adriatic coastline appreciation and tourism infrastructure growth

Multiple Exit Pathways

Real estate component provides additional exit optionality beyond operational sale

Operational Sale

Sell fully operational wellness centre to strategic buyer or hospitality group

Land Development Sale

Develop unused 700 sqm FAR into residential units and sell individually or as package

Land-Only Sale

Sell property to developer capitalizing on location premium and development potential

Comparable Land Transactions (Budva 2024-2026)

| Location | Land Size | Distance to Beach | Price per sqm | Total Price |

|---|---|---|---|---|

| Becici, Budva | 1,500 sqm | 250m | €2,400 | €3.6M |

| Rafailovici | 800 sqm | 200m | €2,600 | €2.08M |

| Old Town Budva | 600 sqm | 400m | €1,800 | €1.08M |

| Our Property (est.) | 1,200 sqm | 300m | €2,000-€2,200 | €2.4M - €2.64M |

* Comparable land transactions sourced from Montenegro Real Estate Association (MREA) and local brokers. Our property valuation is conservative given 300m beach distance and existing structure.

Real Estate Downside Protection

Even if the wellness centre operations underperform, the land alone provides significant value protection. Based on comparable sales, the 1,200 sqm plot is worth €2.4M - €2.64M, representing 48-53% of the total €5M investment. Combined with 5-8% annual land appreciation in Budva's tourism corridor, investors have a real estate floor protecting their downside.

5 Revenue Streams

Diversified income model ensures stability and upside potential

Room Revenue

Accommodation revenue at $200-400/night ADR

Wellness Treatments

IV therapy, ozone, hyperbaric oxygen, massage

Retreat Programs

7/14/21-day longevity and detox retreats

F&B Operations

Organic farm-to-table restaurant and juice bar

Wellness Retail

Supplements, wellness products, branded merchandise

Unit Economics

Projected Returns

Project Timeline

LOI & Due Diligence

Close Transaction

6-Month Reconstruction

Soft Opening (Hotel Rooms)

Grand Opening (Full Wellness)

Ramp to Stabilization

Investment Terms

Market Opportunity

Wellness tourism is the fastest-growing segment of global travel, with Montenegro emerging as a premier Adriatic destination

5-Year Financial Projections

Conservative revenue ramp with improving margins as operations scale

| Year | Revenue | EBITDA | Margin | Occupancy |

|---|---|---|---|---|

| Y1 (2027) | $2.1M | $420K | 20% | 42% |

| Y2 (2028) | $3.8M | $1.14M | 30% | 58% |

| Y3 (2029) | $5.2M | $1.82M | 35% | 68% |

| Y4 (2030) | $5.8M | $2.03M | 35% | 72% |

| Y5 (2031) | $6.1M | $2.14M | 35% | 75% |

Key Assumptions: Year 1 ramp (42% occupancy) during reconstruction completion. Stabilization at 68-75% by Year 3. ADR growth 3% annually. EBITDA margins improve from 20% to 35% as fixed costs are absorbed.

Sensitivity Analysis

Investment returns under different performance scenarios

| Scenario | Stabilized Occupancy | Year 3 EBITDA | Exit Multiple | Exit Value (Year 7) | IRR | MOIC |

|---|---|---|---|---|---|---|

Downside Conservative assumptions | 55% | $1.2M | 6x | $7.2M | 8% | 1.15x |

Base Case Current projections | 70% | $1.8M | 8x | $14.4M | 22% | 2.3x |

Upside Strong performance + brand premium | 82% | $2.6M | 10x | $26M | 32% | 4.2x |

Land-Only Exit Downside protection floor | N/A | N/A | — | $3.2M | -8% | 0.51x |

Downside Assumptions

- • Lower occupancy (55% vs 70%)

- • Extended ramp period (3 years)

- • ADR 10% below target

- • Lower exit multiple (6x vs 8x)

- • Limited wellness premium

Base Case Assumptions

- • 70% stabilized occupancy

- • 2-year ramp to stabilization

- • €195/night blended ADR

- • 8x EBITDA exit multiple

- • Moderate wellness premium

Upside Assumptions

- • Premium positioning (82% occupancy)

- • Faster ramp (18 months)

- • ADR premium (+15% from wellness)

- • Higher exit multiple (10x brand value)

- • Strong LGC ecosystem network effects

Sensitivity Insights

IRR Range: Even in the downside scenario (55% occupancy, 6x exit multiple), the investment generates an 8% IRR. Base case delivers 22% IRR, with upside potential to 32%.

Occupancy Sensitivity: Every 5% change in stabilized occupancy affects IRR by ~3-4 percentage points. Budva's 68% average hotel occupancy (2023) supports our 70% base case assumption.

Land Floor Protection: The land-only exit scenario (selling undeveloped property at current market rates) would return $3.2M on $6.25M invested (51% capital recovery). This represents true downside protection independent of operational performance. With 700 sqm unused FAR, actual land value with development rights is likely $4-5M.

Exit Multiple Impact: Each 1x change in exit multiple changes IRR by ~4-5 percentage points. Wellness properties command 8-12x EBITDA multiples; our 8x base case is conservative relative to comparables.

Unit Economics

Strong per-room contribution margins with 66% profitability at stabilized occupancy

Blended room + wellness rate

At 68% stabilized occupancy

All-in OpEx per guest night

Per occupied room (66%)

Blended marketing cost

4.2 nights avg stay, 2x return rate

Competitive Landscape

Positioned as "accessible luxury" with science-based longevity protocols—differentiated from traditional hospitality spas

| Property | Positioning | ADR Range | Key Differentiator |

|---|---|---|---|

| Aman Sveti Stefan | Ultra-Luxury | $900-1,500 | 3x more expensive, lifestyle vs. longevity |

| Chedi Luštica Bay | Luxury Hospitality | $400-700 | Traditional spa, not longevity protocols |

| One&Only Portonovi | Luxury Resort | $500-900 | Hospitality-first, limited wellness depth |

| LGC Montenegro | Accessible Luxury | $280-450 | Science-based longevity, IV/ozone/hyperbaric |

Our Competitive Advantage: The LGC Montenegro centre will offer a custom wellness concept with premium retreat programs, holistic wellness services, and accessible luxury pricing. Traditional resorts offer basic spa; ultra-luxury properties are 3x more expensive.

Target Customer Personas

Four distinct guest segments with strong willingness-to-pay for longevity-focused wellness experiences

European Wellness Seekers

40%Demographics: Ages 45-65, €150K+ income, Germany/UK/France

Psychographics: Preventive health focused, biohacking interest, longevity mindset

Avg. Spend: $3,200 / 5-night stay

GCC High Net Worth

30%Demographics: Ages 35-55, $300K+ income, UAE/Saudi/Kuwait

Psychographics: Health optimization, European travel preference, wellness as status

Avg. Spend: $4,500 / 7-night stay

Russian/CIS Affluent

20%Demographics: Ages 40-60, €100K+ income, Moscow/St. Petersburg

Psychographics: Adriatic destination loyalty, wellness + leisure balance

Avg. Spend: $2,800 / 5-night stay

Global Longevity Enthusiasts

10%Demographics: Ages 50-70, $200K+ income, US/Asia/Australia

Psychographics: Early adopters, biohacking community, protocol-driven

Avg. Spend: $5,200 / 10-night stay

Go-to-Market Strategy

Multi-channel distribution with emphasis on direct bookings and longevity centre partnerships

Booking Platform

25%Direct bookings via dedicated wellness booking platform

Longevity Centre Partnerships

20%Referrals from UAE/EU anti-aging doctors

Booking.com / OTAs

20%Premium OTA presence (15% commission)

Direct Website / SEO

15%Organic search + content marketing

B2B Corporate Wellness

12%Executive retreat packages for companies

Influencer / PR

8%Longevity influencers, wellness media

Distribution Advantage: Our Booking Platform (in development) will provide low-CAC direct bookings ($80 vs. $150 OTA). Longevity centre partnerships create warm referrals ($60 CAC). Blended LTV:CAC ratio of 20:1.

Team & Management

Experienced wellness hospitality operators with proven track record in luxury resort development

Taya Bessmertnaya

Founder & CEO, Longevity Capital

15+ years in hospitality and wellness. Former operations director at luxury spa resorts. Built the wellness centre concept and operations framework from ground up in Turkey.

View ProfileGeneral Manager (TBH)

On-Site Operations Lead

Hiring hospitality veteran with 10+ years Adriatic luxury resort experience (Aman/Chedi alumni preferred).

Medical Director (TBH)

Medical Director

Hiring EU-licensed physician with longevity medicine certification. Required for medical device operation (hyperbaric chamber, IV lounge) and EU compliance (CE marking).

Wellness Program Director (TBH)

Retreat & Treatment Coordination

Hiring certified wellness practitioner (Ayurveda, yoga, nutrition) to design and manage retreat programs and guest treatment journeys.

Consulting Team

Construction & Launch Support

In-house consulting arm provides SOP development, staff training, and pre-opening operations setup.

View ProfileTraction & Validation

Deal in progress with early market validation from Turkey wellness centre guest base

LOI Submitted

CompleteApril 2026

Letter of Intent signed with property owner

Due Diligence

In ProgressMay-July 2026

Legal, structural, title, zoning review

Pre-bookings Interest

Ongoing120+ waitlist signups from Turkey wellness centre guests

Partnership MoUs

In ProgressQ2 2026

LOIs from 3 UAE longevity centres for referrals

Comparable Transactions

Recent wellness real estate exits demonstrate strong investor appetite and premium valuations

Euphoria Retreat, Greece

45 rooms • 2023

Buyer: Private equity fund

SHA Wellness Clinic, Spain

93 rooms • 2021

Buyer: Strategic hospitality group

Lanserhof Sylt, Germany

50 rooms • 2022

Buyer: REIT rollup

Valuation Benchmark: Comparable wellness properties trade at 8-12x EBITDA or 6-8x revenue. At $1.8M EBITDA (Year 3), implied valuation range is $14-22M. Conservative 10x exit multiple suggests $18M exit value on $6.25M invested capital.

Exit Scenarios

Multiple exit pathways with attractive returns across base, upside, and conservative scenarios

Strategic Sale

Acquisition by hospitality group (Hyatt, Marriott, Aman) or wellness chain (Six Senses, Lanserhof)

REIT Rollup

Package with other LGC wellness centres into wellness REIT or institutional buyer

Refinance + Hold

Return 70% of LP capital via refinance, hold for long-term yield (12-15% cash-on-cash)

Investment Structure

ADGM-based SPV with institutional-grade governance and investor protections

Legal Entity

ADGM SPV (Abu Dhabi Global Market Special Purpose Vehicle)

Governance

Quarterly investor updates, annual audited financials, advisory board seat for $1M+ LPs

Carried Interest

20% carry to GP after 12% preferred return to LPs

Distribution Waterfall

100% to LPs until 12% return, then 80/20 split (LP/GP)

Management Fee

1.5% annually on committed capital (years 1-3), 1% thereafter

Co-Investment

GP commits $940K (15% skin in the game)

Reporting Cadence

Monthly dashboard, quarterly financials, annual strategy review

Liquidity Rights

No liquidity until exit; secondary market transfer allowed with GP approval

Frequently Asked Questions

Common questions from prospective investors

Why Montenegro vs. other Adriatic destinations?

Montenegro offers EU candidate status (regulatory stability), lower acquisition costs vs. Croatia, direct flights from UAE/Russia/UK, and proven tourism growth (23% YoY). Budva is the highest-traffic coastal city with 300+ days of sunshine.

What if occupancy is lower than projected?

Base case assumes 68% stabilized occupancy (Year 3). Conservative scenario: Even at 55% occupancy, EBITDA is $1.2M (23% margin), achieving 18% IRR. Diversified revenue (35% rooms, 65% wellness/F&B) provides downside protection.

How liquid is this investment?

Illiquid until exit (7-10 years). Secondary transfers allowed with GP approval, but no active secondary market. This is a long-term real estate + operating business investment.

Can I visit the property before committing?

Yes. Site visits arranged for serious investors ($500K+ interest). Property currently operating as a hotel, so you can experience the location firsthand.

What is the minimum hold period?

Minimum 5 years (lock-up period). Target exit 7-10 years. Early liquidity only via secondary sale with GP consent.

How does this fit into the LGC ecosystem?

Montenegro is the flagship European centre. Success here unlocks 3-4 additional Adriatic locations (Croatia, Greece). The Booking Platform will drive direct bookings. Our AI Application provides guest LTV optimisation. Training Academy trains staff.

What are the tax implications?

SPV domiciled in ADGM (tax-neutral jurisdiction). Investors responsible for taxes in their home jurisdiction. Consult your tax advisor. K-1 equivalent provided annually.

What regulatory approvals are required?

Operating license (hotel + wellness) from Montenegro Ministry of Tourism. Medical device approvals (hyperbaric chamber, IV lounge) via EU CE marking, requiring on-site Medical Director. Legal team handling all permits and compliance.

Risk Factors & Mitigation

Construction delays could push opening timeline beyond Q1 2027

Regulatory approvals for wellness treatments may vary by jurisdiction

Seasonal tourism in Montenegro (peak May-September, lower Oct-April)

Currency risk (EUR-based operations, USD investor returns)

Competition from established Adriatic wellness resorts

Economic downturn could impact luxury wellness travel demand

Mitigation: SPV structure isolates risk per asset. Experienced consulting team will oversee construction and operations. Diversified revenue streams reduce dependency on any single income source. Target demographic (EU + Arab HNW) has proven resilience to economic cycles.

15+ Years

Wellness & Hospitality

Let's Discuss This Opportunity

"Montenegro represents a unique convergence of accessible pricing, premium location, and untapped wellness demand. I personally oversee every investment in the LGC network — this isn't a passive fund, it's a hands-on operating partnership."

1-on-1 Consultation: Review financials, tour property (virtually or in-person), discuss your investment criteria

Investor Deck Access: Detailed financial model, legal structure, operational playbook

Due Diligence Support: Connect with our legal team, tour comparable properties, meet advisory board

Taya Bessmertnaya

Founder & CEO, Longevity Capital

Join This Investment Opportunity

Closing August 2026. Qualified investors only. Minimum commitment $750,000.

Securities disclaimer: This is not an offer to sell securities. Investment opportunities available only to qualified/accredited investors under ADGM regulations. Past performance does not guarantee future results.